Editor’s Note: This article is part of MOAA’s 2023-24 TRICARE Guide, brought to you by MOAA Insurance Plans, administered by Association Member Benefits Advisors (AMBA). A version of the guide appeared in the November 2023 issue of Military Officer magazine.

Editor’s Note: This article is part of MOAA’s 2023-24 TRICARE Guide, brought to you by MOAA Insurance Plans, administered by Association Member Benefits Advisors (AMBA). A version of the guide appeared in the November 2023 issue of Military Officer magazine.

A top priority for MOAA in the second half of the 118th Congress is protecting TRICARE beneficiaries from excessive pharmacy copay increases.

With the FY 2018 National Defense Authorization Act (NDAA), Congress gave DoD the authority, starting in 2028, to set prescription drug copays to reflect changes in pharmacy program costs. MOAA is concerned the Defense Health Agency might use this authority to implement excessive copay increases.

Setting Up ‘Guardrails’

Next year, MOAA will work to achieve statutory guardrails on this authority, consistent with past legislation governing the TRICARE pharmacy benefit.

TRICARE For Life legislation in the FY 2001 NDAA expanded the TRICARE home delivery and retail pharmacy programs to Medicare-eligible retirees who had previously been limited to filling prescriptions at military treatment facility (MTF) pharmacies.

[TRICARE GUIDE: Can Online Pharmacy ‘Disruptors’ Save You Money?]

Initial TRICARE pharmacy copays, established by DoD, followed legislative intent and were aligned with commercial plan benchmarks. Since then, Congress has legislated pharmacy copay increases.

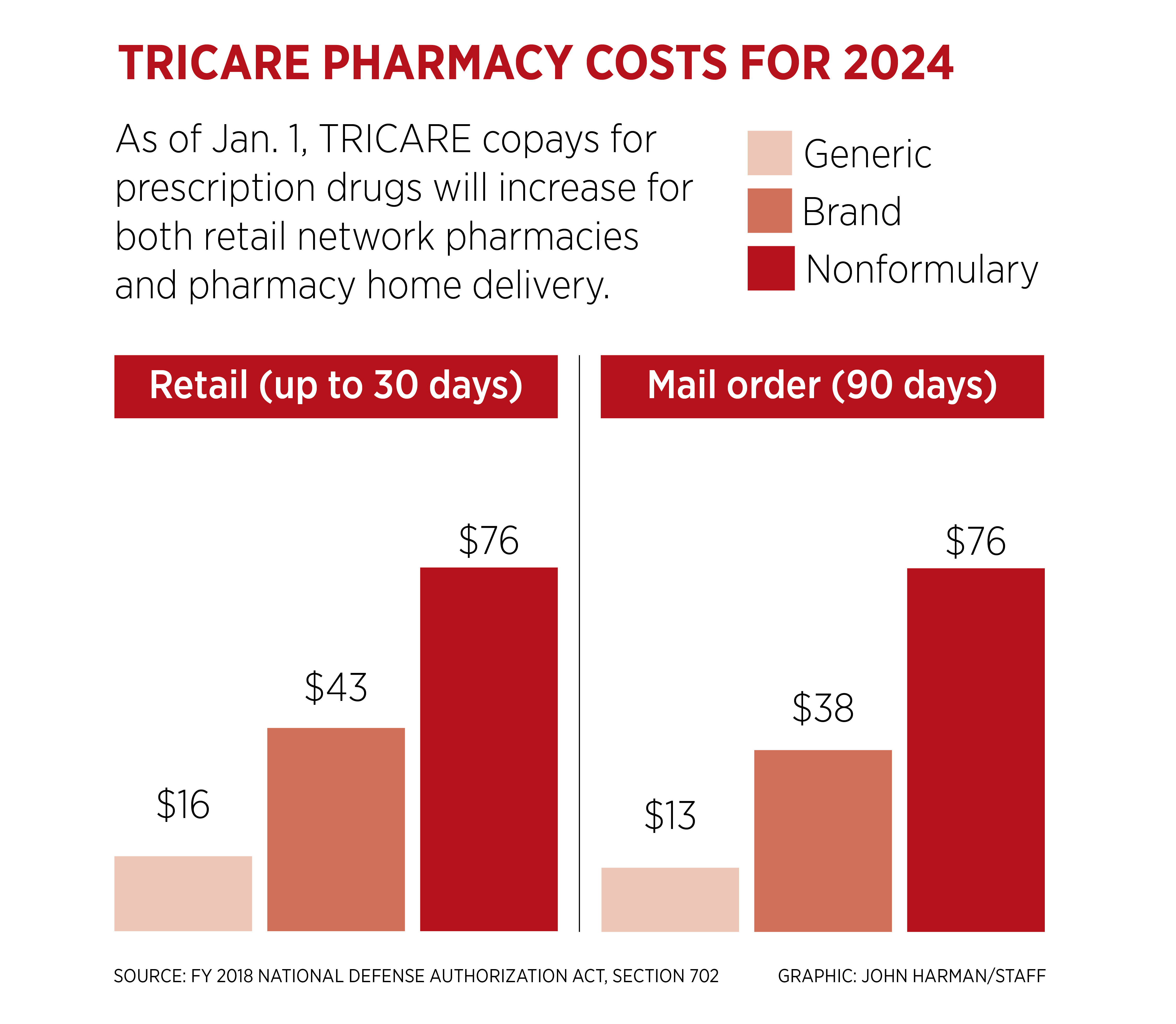

Most recently, Congress included a table in the FY 2018 NDAA with biennial pharmacy copay increases through 2027. Those increases have aligned TRICARE copay levels with those in other employer-sponsored plans.

The Kaiser Family Foundation (KFF) Employer Health Benefits Survey reports average copays of $11, $37, and $67 for drugs in the first, second, and third tiers. TRICARE retail pharmacy copays are $14 for generic, $38 for brand-name, and $68 for nonformulary drugs for a 30-day supply.

Copays for a 90-day supply via mail order are $12, $34, and $68 for generic, brand name, and nonformulary, respectively. Prescription medications obtained at an MTF pharmacy have zero cost sharing.

[TRICARE GUIDE: Understanding Pharmacy Network Cuts]

Unlike many commercial plans, TRICARE does not have a separate tier for specialty drugs, such as biologics, that may be used to treat chronic conditions or some cancers. Specialty drugs can be expensive and often require special handling, administration (e.g., injection or infusion) and patient monitoring.

The KFF reports approximately 61% of workers at large firms are in a health plan with at least one cost-sharing tier just for specialty drugs. The average copay for specialty drugs in these plans is $103 and the average cost share is 25%.

MOAA appreciates the TRICARE pharmacy program does not have a separate, more expensive tier for specialty drugs but is concerned about the future of TRICARE pharmacy copays.

MEDIPLUS® TRICARE Supplement

Works hand-in-hand with your Select or Prime Plan. Count on valuable protection.