By MOAA Staff

An opinion piece by a MOAA board member pushes Congress to end the “widows tax” – a policy that forces surviving military spouses to forfeit part or all of their DoD-provided Survivor Benefit Plan annuity when they begin receiving Dependency and Indemnity Compensation through the VA.

The offset “defies logic and should be repealed,” writes Rear Adm. Tom Jurkowsky, USN (Ret), in a piece published April 20 at The Hill.

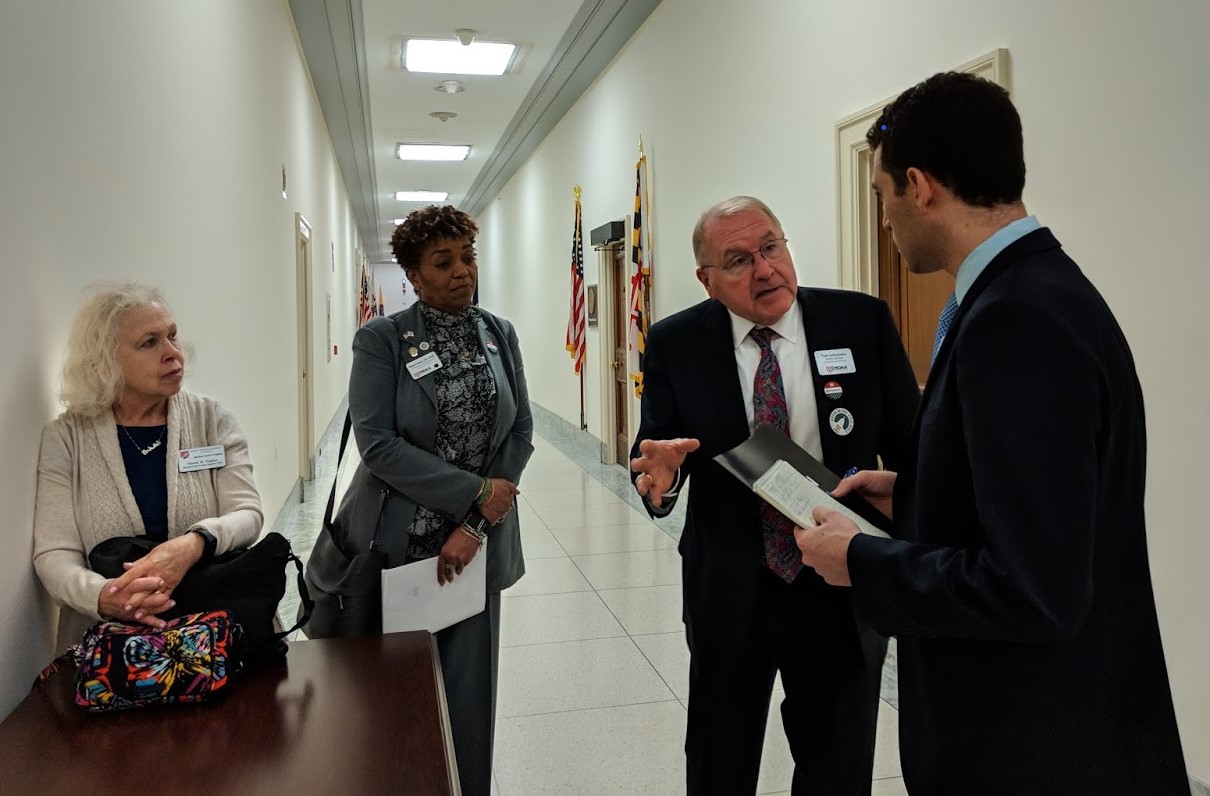

Ending the offset has long been a top mission for MOAA. On April 10, more than 170 MOAA members met with members of Congress on the Hill to discuss ending the tax during the annual Storming the Hill event.

[TAKE ACTION: Tell Your Representative to End the Widows Tax]

“What other insurance policy sold in the United States is permitted to withhold a death payment to a legal beneficiary?” Jurkowsky asks in the piece. “Would this be allowed to happen if a company selling life insurance withheld death payments from beneficiaries? The courts would certainly intervene, as would Congress. So why should the widows tax be allowed to continue?”

About 66,000 surviving military spouses are affected.

As of late April, there are 233 House members and 57 senators who have cosponsored legislation to repeal the widows tax.