Note: This commentary by MOAA Board Member Rear Adm. Tom Jurkowsky, USN (Ret), originally appeared in The Oklahoman newspaper.

For those who have served, or are serving, Oklahoma Sen. Jim Inhofe has our deepest respect. As chairman of the powerful Armed Services Committee, Inhofe continually proves his commitment to rebuild our military. The senator also cares deeply about military people and their families.

An issue exists that desperately requires the senator’s leadership and legislative skills. The issue is known as the widows tax.

Under current law, military survivors whose sponsors die from service-connected causes must forfeit part or all of their purchased military survivor benefits when they receive Dependency and Indemnity Compensation from the VA. These separate benefits offset each other, meaning every dollar a widow or widower receives in military survivor benefits is reduced for every dollar from the VA.

In effect, military survivor benefits become the only insurance-type product that you pay into but can legally be prohibited from collecting.

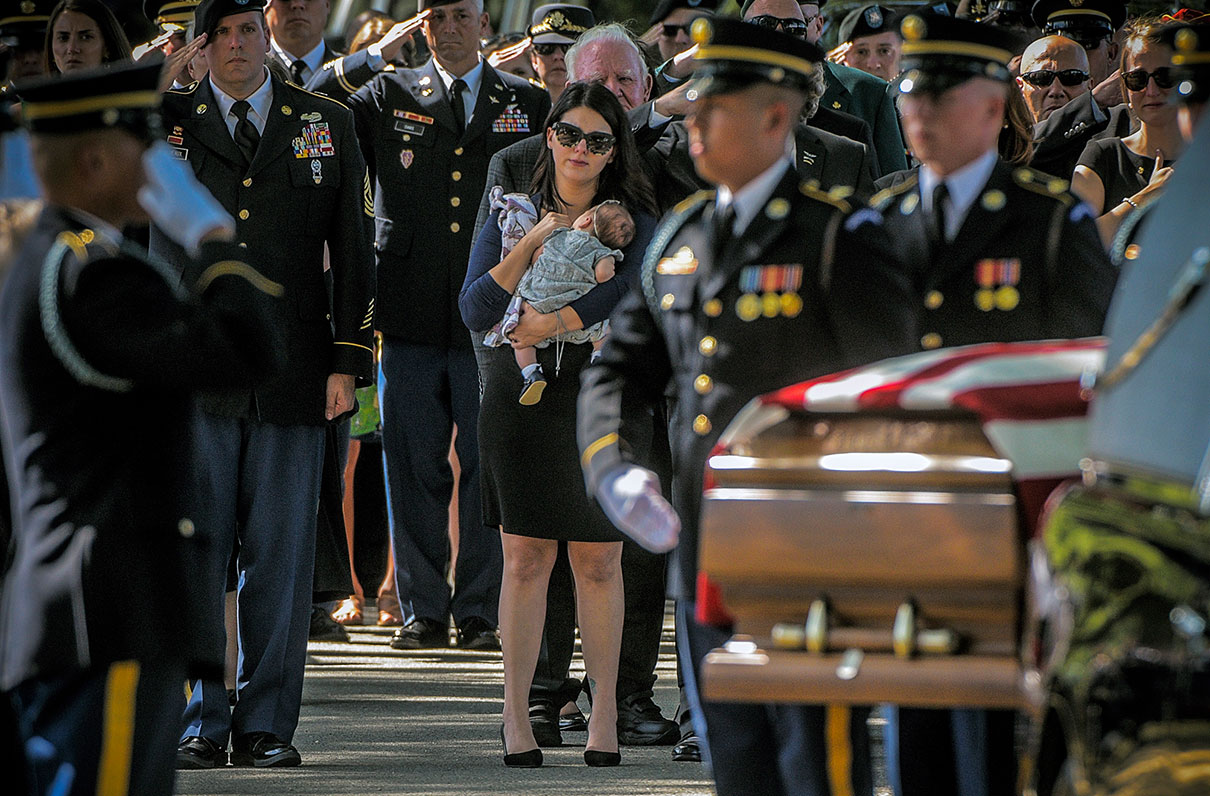

This is an incomprehensible injustice affecting 65,000 survivors across the country. Just recently, two more spouses joined the roles after their husbands were killed in Afghanistan. Both left behind a wife and children. Money the spouses thought they would be receiving — and should be receiving — will be taken from them. As a matter of note, more than 1,500 Sooners lose up to $12,000 per year due to the widows tax.

Congressional members, including Inhofe, took huge steps earlier this year to correct this injustice. Standalone legislation to repeal the widows tax earned overwhelming bipartisan support in both chambers of Congress: 380 House and 76 Senate co- sponsors.

[TAKE ACTION: Ask Your Lawmaker to Support These Critical Defense Bill Provisions, Including an End to the Widows Tax]

Although lawmakers support fixing the problem, they failed to find a way to pay for it.

The House version of the fiscal year 2020 defense bill includes language to repeal this offset. House and Senate lawmakers must now resolve any differences to ensure the elimination of the widows tax remains part of the final defense bill.

But because of Washington’s focus on impeachment, the border wall and other items, legislation regarding the widows tax will only survive with Inhofe's continued and dedicated leadership. It is up to him to convince his colleagues to fix this problem now.

When Sen. Inhofe says, “Thank you for your service” to those serving and those who have served, we know he means it. But the senator needs to call the bluffs of his colleagues who also utter the phrase. Because if they meant it — if they truly appreciated what it meant to serve your country and then give your life for it — they would join Inhofe and repeal the widows tax once and for all.

[RELATED: MOAA Resources: The Widows Tax]

Ethically and morally, how can we not provide the monetary compensation to surviving spouses that they deserve? How can we treat the surviving spouses of those who have given their lives to our country like this?

It’s time for Inhofe’s colleagues to join him and fix this travesty.